- | Government Spending Government Spending

- | Data Visualizations Data Visualizations

- |

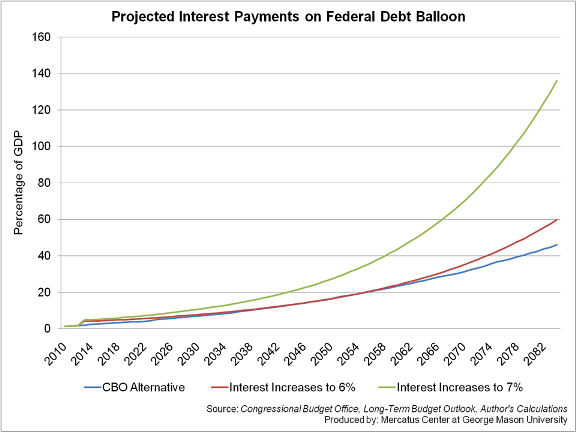

Projected Interest Payments on Federal Debt Balloon

This chart by Mercatus Center Senior Research Fellow Veronique de Rugy examines likely options for the long-term cost of carrying the debt held by the public if investors begin to demand higher

This chart by Mercatus Center Senior Research Fellow Veronique de Rugy examines likely options for the long-term cost of carrying the debt held by the public if investors begin to demand higher interest rates. This chart compares the Congressional Budget Office Alternative projection of net interest costs, which incorporates likely policy changes while assuming that the interest remains constant at just below 5%, with these same projections at long-term interest rates of 6% and 7%. At an interest rate of 6%, the interest cost of the debt balloons to 59.8% of GDP by 2084, at an interest rate of 7%, this cost more than doubles to 136% by 2084.

United States debt is primarily held short-term, and had long-benefitted from low interest rates due to its level of security relative to other sovereign debt

Dr. de Rugy discusses our unsustainable debt.