- | Financial Markets Financial Markets

- | Data Visualizations Data Visualizations

- |

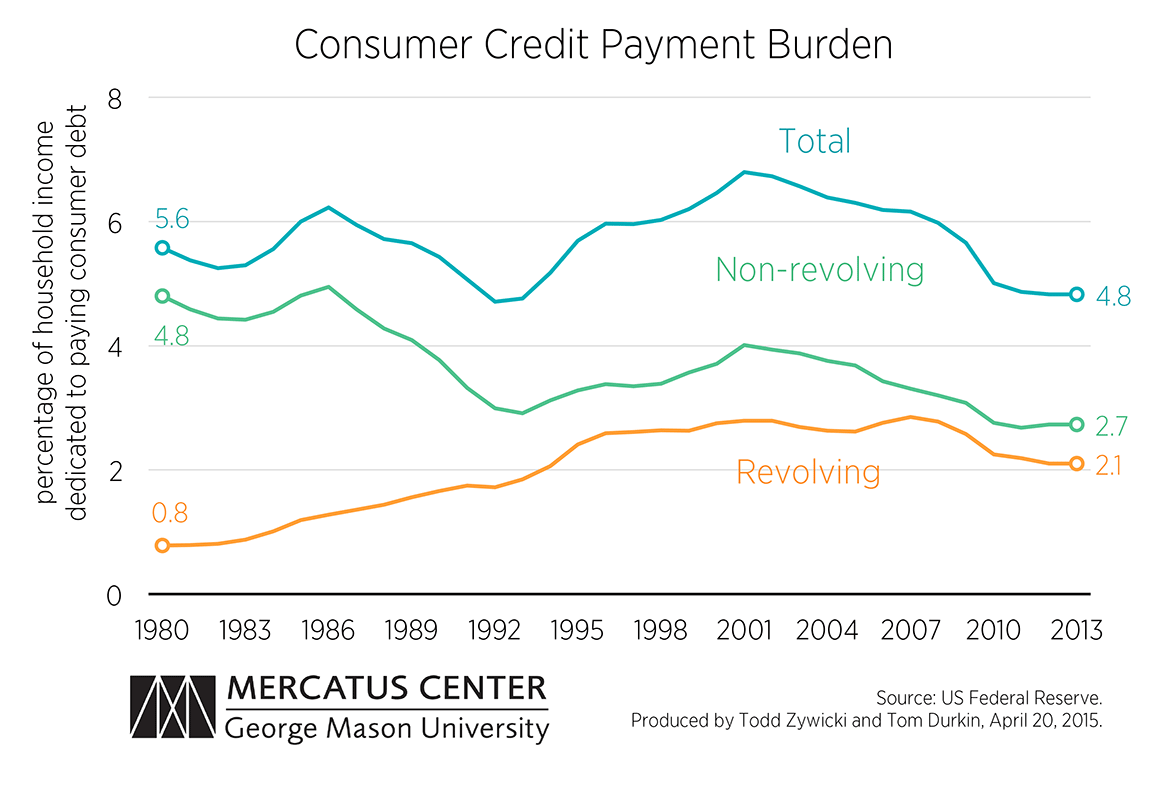

Credit Cards Have Not Increased Consumer Debt Burden

The chart this week shows that, contrary to conventional wisdom, the debt-service ratio of household consumer debt has not risen over time. In fact the debt-service ratio is actually lower today than in 1980.

Consumer advocates argue that widespread availability of credit cards encourages consumers to take on excessive debt. Consequently, there is an effort to impose new regulations on credit cards and other credit sources to limit their use.

The data, however, do not show a ballooning consumer credit payment burden. The chart below shows that, contrary to conventional wisdom, the debt-service ratio of household consumer debt has not risen over time. In fact the debt-service ratio is actually lower today than in 1980.

What has changed is the composition of consumer debt as credit cards replaced installment loans from retailers and personal finance companies over time. There is, therefore, little empirical support for the notion that increased prevalence of credit cards have led to some sort of explosion in consumer debt. Regulations seeking to limit their use might well be a solution in search of a problem.